- Location

- Glamping

Special occasions

- Stories

- Gift Cards

- About us

About Canopy & Stars

More from Canopy & Stars

More at Sawday's

Space type popularity

Cabins thrive, design is king

The wider market

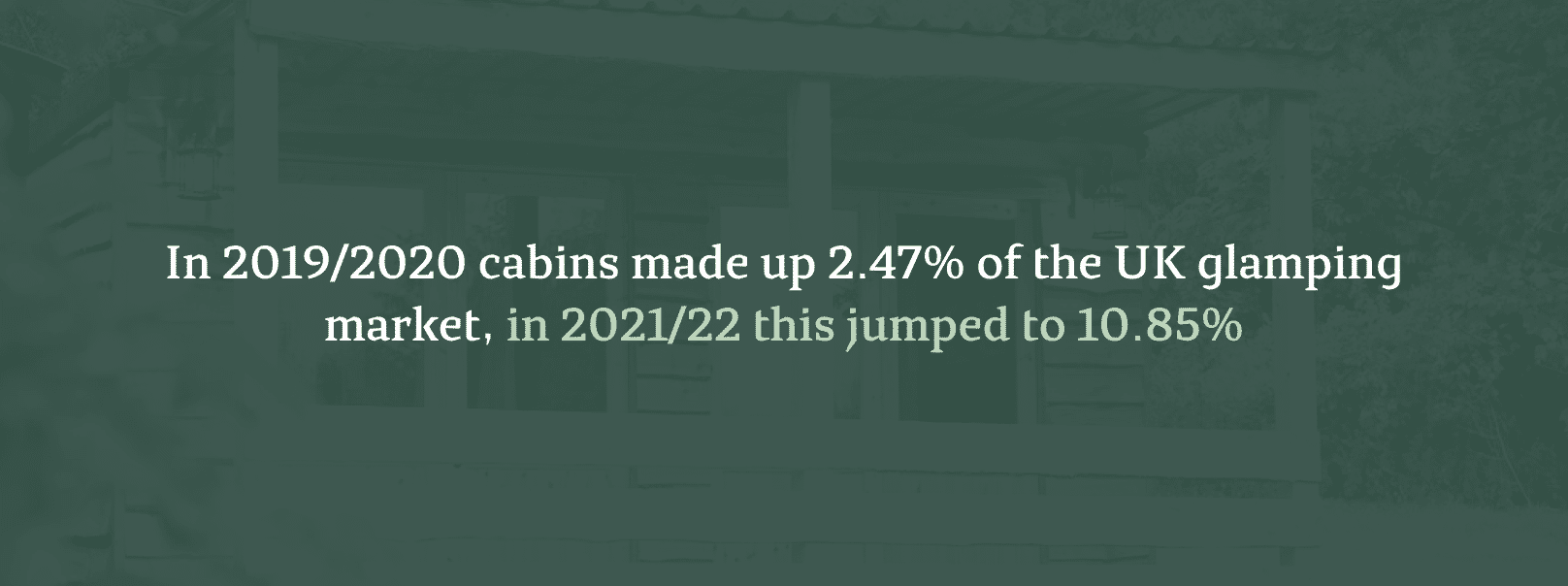

As the glamping market matures and develops, it’s seeing a dramatic shift away from its origins in bell tents, yurts and geodomes to more substantial, year-round spaces. Treehouses have always been the market leader when it comes to glamping revenue but in recent years, cabins have seen a rise in popularity and demand. According to the Crown & Canopy market report, in 2019/2020 cabins made up 2.47% of the UK glamping market, but this rose to 10.85% in 2021/2022. This was comfortably the largest increase of any space type.

Whilst the market is growing, mainstream popularity brings competition and a concurrent rise in the expectations of guests. People are willing to pay for opportunity to stay in a space with unique features and authentic experiences, which cabins and treehouses can more easily incorporate.

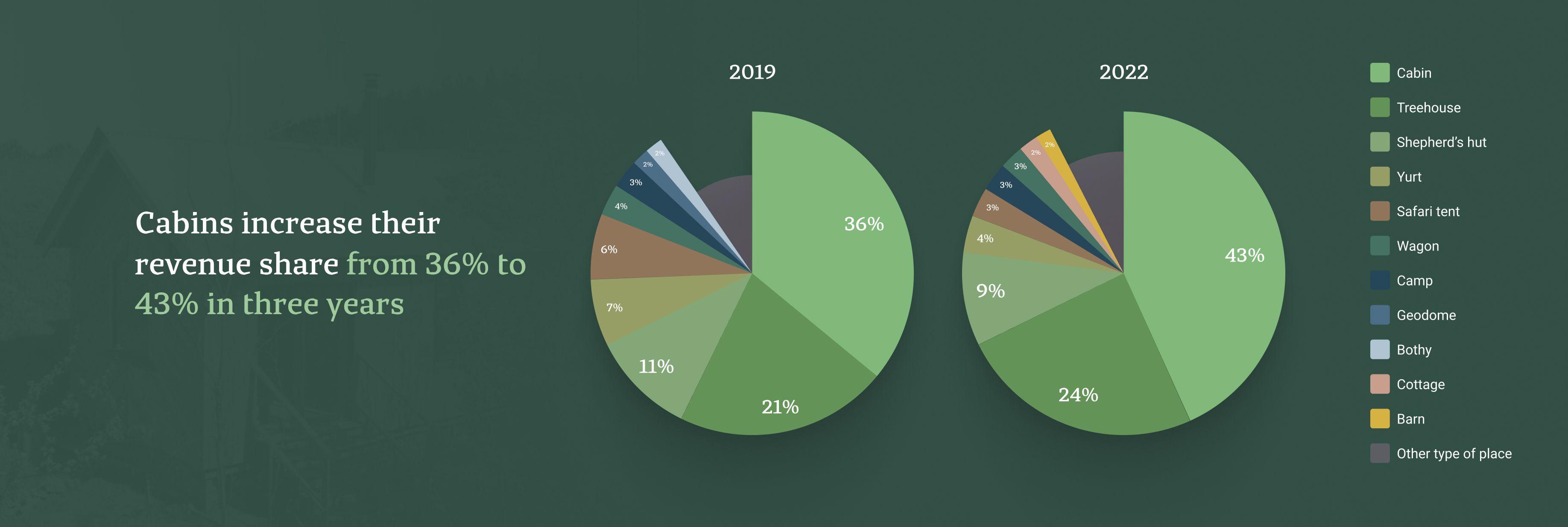

Within Canopy & Stars

Our own revenue statistics confirm the increased viability of more permanent structures. Only cabins and treehouses exceeded 2021’s pandemic-inflated booking revenue (comparing 2021 full year’s booking revenue to 2022 YTD booking revenue), more than doubling when compared to 2019’s. In 2019, cabins contributed 36% of our revenue, but this has increased to 43% in 2022, with treehouse revenue going from 21% to 24% over the same period. These gains are coming from the downturn in popularity of the more classic glamping structures, especially those constructed in canvas such as safari tents, which have fallen from a revenue share of 6% in 2019 down to only 3% in 2022.

Cabins and treehouses outperform other spaces in another key metric besides revenue share -- occupancy. The longer season contributes to this, but so does the ability of those spaces to house desirable features. In 2019 the average total occupancy of our UK cabins was 59% and this has risen to 65% to date in 2022, with some strong booking periods still to come. The average UK treehouse occupancy for the same period has risen from 74% to 81%, again with room to grow, but still amply demonstrating the desire of consumers for standout spaces. The market is responding to this by adapting their sites and what they are offering to guests. Brook House Woods evolved their spaces based on demand, removing their yurt and replacing it with a large treehouse for 8, also adding the woodland cinema as an experiential feature. The Orchard, in Somerset also achieved record occupancy by launching a new space with a beautiful bath house and clever redesign, which we examine in more detail here.